Mortgage Rates Today: Unlocking the Trends for Your Financial Future

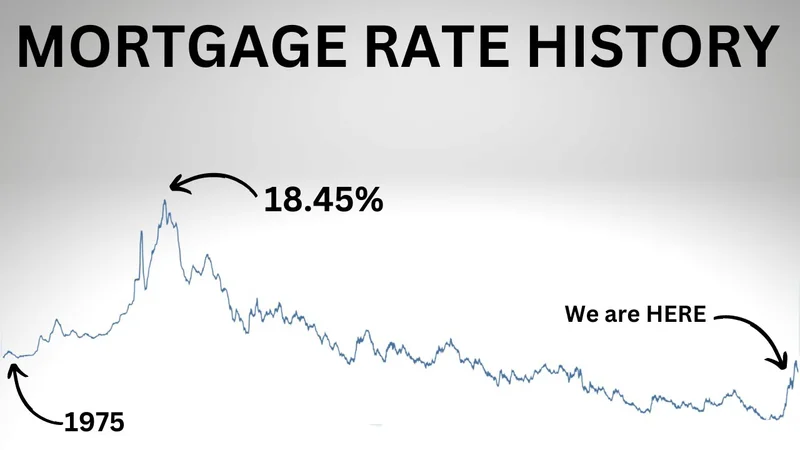

Alright, buckle up, everyone! I've been glued to the mortgage rate reports, and I've got some exciting news to share. We’re seeing some real movement, a definite dip, and the question on everyone’s mind is: Is now the moment to refinance? I'm seeing averages for 30-year fixed-rate loans hovering around 6.2% to 6.3% [Zillow, Optimal Blue, Forbes Advisor]. That’s not quite the rock-bottom rates of the pandemic era, but let’s be real, those were an anomaly—a blip in history we probably won’t see again.

What's Actually Happening?

What's fascinating is why this is happening. Remember all the hand-wringing when the Fed started cutting the federal funds rate last year, and mortgage rates just… didn’t budge? I mean, some of us were expecting rates to fall in tandem with cuts made by the Federal Reserve to the federal funds rate late last year, but that didn’t happen, and mortgage rates remained stubbornly near the 7% mark. It felt like the market was playing a cruel joke. Turns out, it just took a little while for the gears to grind and the message to get through. We finally saw some downward movement in late August and early September, and now it looks like that trend is picking up steam.

And get this, according to Forbes Advisor, the average 30-year fixed mortgage rate has remained in the mid-to-high 6% range since late January 2025. While interest rates have fallen since mid-January 2025, experts expect them to remain relatively steady for the remainder of the year. If the Federal Reserve continues to cut the federal funds rate, it’s possible that mortgage rates will decrease in 2026.

But here's the thing: waiting for rates to bottom out is like waiting for the perfect stock price—you'll probably miss the boat. A bird in the hand is worth two in the bush, as they say. So, what does this mean for you? Well, if you're sitting on a mortgage rate of, say, 7% or higher, this could be your moment.

The key, as always, is to do your homework. NerdWallet suggests refinancing might make sense if today’s rates are at least 0.5 to 0.75 of a percentage point lower than your current rate (and if you plan to stay in your home long enough to break even on closing costs). You can stay up to date with the latest information by checking the Mortgage Rates Today, Tuesday, November 25: Kind of a Big Jump.

Think of it like this: refinancing is like pruning a tree. You might lose a few branches (closing costs) in the short term, but you're setting yourself up for healthier growth (lower monthly payments, more financial flexibility) in the long run.

And don't forget about the other potential benefits of refinancing. Maybe you want to tap into your home equity for renovations, consolidate debt, or switch from an adjustable-rate mortgage to a fixed-rate one. The possibilities are endless!

Of course, there are factors outside of your control. The health of the U.S. economy is probably the biggest driver of mortgage rates. When lenders worry about inflation, they can bump up rates to protect their profits down the road. The Federal Reserve also plays a key role, and can influence mortgage rates by changing the federal funds rate and by buying or selling assets.

But here's what is in your control: your credit score, your debt-to-income ratio, and your willingness to shop around for the best deal. Get your financial house in order, compare offers from multiple lenders, and don't be afraid to negotiate.

And hey, if you're already in a good spot with a low rate, that's fantastic! But even then, it's worth keeping an eye on the market. You never know when an opportunity might arise to optimize your financial situation even further.

This Could Be Your Launchpad!

I am really excited about this news and what it means for the market. I am also a little nervous. We have to remember to be responsible with these new opportunities. Let's make sure we are making wise financial decisions.

So, what’s the real story? This isn’t just about numbers on a screen. This is about families gaining breathing room, dreams becoming attainable, and a sense of stability in an uncertain world. It's about using these lower rates as a launchpad to build a brighter future, one mortgage at a time.

Tags: mortgage rates today

TransUnion's Latest Data: What It Reveals About Consumer Credit and the Road Ahead

Next PostBABA Stock: The AI Breakthrough Driving Its Surge – And What It Means For Tomorrow

Related Articles